Looking ahead in 2026

What Seattle Buyers & Sellers Need to Know

I've had more conversations this past year that started with "We're pulling it off the market" than I've had in years. Each one tells a different story—a family that couldn't stomach the lowball offers, a couple who decided their 3% mortgage was too good to give up, someone who just got tired of the Sunday open houses where only three people showed up.

If you tried to sell your home in 2025 and felt like you were pushing a boulder uphill, you weren't alone. But as we step into 2026, something fundamental is shifting in the Seattle housing market, and it's worth understanding what that means whether you're buying, selling, or just trying to figure out your next move.

What 2025 Taught Us

The numbers from 2025 tell a clear story. Nationally, 85,000 homes were pulled off the market in September alone, representing a 28% jump from the year before. Here in the Seattle-Tacoma-Bellevue area, active listings spiked 46% from the previous July, while homes sat on the market for a median of 52 days—the longest we'd seen for any July in a decade.

By year's end, home price growth had dropped to just 1.1% nationally, the lowest since 2012. Mortgage rates averaged 6.6% for the year and closed out around 6.3%, while pending home sales fell 5.8% year-over-year in mid-December, marking the biggest decline since early 2025.

These weren't just statistics. They represented real people making hard decisions in a market that had fundamentally changed from what we experienced in 2020-2021.

Why 2025 Was So Challenging

It wasn't just one thing that made last year difficult. Multiple forces collided at once, and Seattle's tech-heavy economy meant we felt the impact more acutely than most markets.

Tech Layoffs Shook Our Foundation

The numbers tell the story. Amazon announced 14,000 corporate cuts in October 2025, with more than 2,300 hitting Washington state. Microsoft slashed over 3,200 jobs locally as part of 15,000 global reductions. And those are just the headliners—Seattle saw over 151,000 tech employees laid off in 2024 alone.

But here's what the numbers don't capture: for every person who lost their job, there were ten more teammates who suddenly felt less secure. When your neighbor gets laid off from Amazon, you start thinking twice about taking on a bigger mortgage, even if your own job is safe. SmartAsset ranked our metro area as having the third-highest rate of "layoff anxiety" in the country, and that fear rippled through every corner of our local economy. Restaurant closures, decreased retail spending, service businesses seeing slowdowns—the confidence crisis reached far beyond the tech sector itself.

The Low-Rate Lock

Here's the part sellers don't always say out loud: many are sitting on mortgage rates around 3%, and the thought of giving that up to buy something else at 6.5% or 7% feels paralyzing. Nearly half of the homes pulled off the market in 2025 belonged to people who bought within the last five years. They're not just disappointed about their asking price—they're genuinely stuck between a home that doesn't quite work anymore and a mortgage rate they'll never see again.

The Expectation Gap

I spoke with Erica Andrews, a Mortgage Loan Originator with Generations Home Loans (@andrewshomeloans on Instagram), about what she's been seeing from the lending side.

"Buyers today have more negotiating power than they've had in years," she explained, "but many sellers are still pricing like it's 2021. The disconnect between seller expectations and buyer reality is creating this wave of delistings we're seeing across Seattle and Snohomish County."

The data backed this up throughout 2025. Seventy percent of listings in September were sitting for 60 days or more, and 68% of sellers said they'd pull their listing entirely if they couldn't get the number they wanted. That's not stubbornness—it's rational math when you're holding a 3% mortgage and looking at 6.5% rates on the other side.

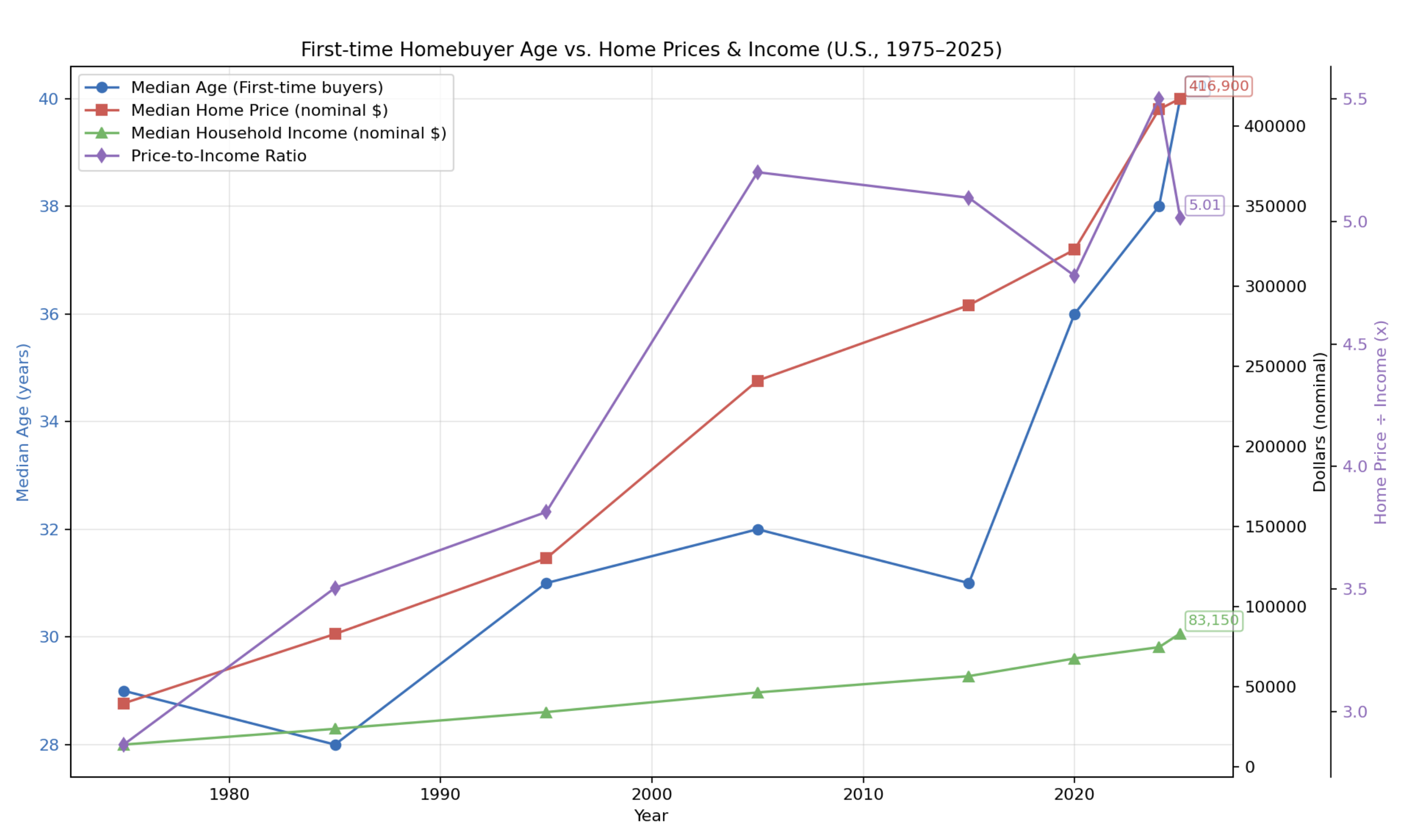

The Age Gap That Explains Everything

Here's something else that helps explain what we're seeing: according to recent lending data, the average home seller is now 68 years old, while the average buyer is 40. This 28-year gap matters more than you might think.

Sellers at 68 typically have massive equity, low or no mortgage payments, and the financial stability to wait for their number. They've been through multiple market cycles and aren't easily spooked by temporary downturns. Many are considering downsizing but aren't desperate to move tomorrow.

Buyers at 40 are a different story. They're established in their careers but cautious, having lived through the 2008 financial crisis and the pandemic. They're often buying for growing families who need space now, not in two years. They're motivated but methodical, and while they have leverage, they're using it carefully rather than making panic offers.

This generational difference shapes nearly every negotiation happening in today's market.

What Makes 2026 Different

As we start this new year, the housing market is entering what experts are calling "The Great Housing Reset." For the first time in over a decade, income growth is expected to outpace home price growth. Let that sink in—affordability is actually improving, not getting worse.

Here's what the data is telling us about 2026. Mortgage rates are predicted to average around 6.3%, which isn't dramatically lower but represents welcome stability after years of volatility. Home prices in the Seattle MSA are projected essentially flat at +0.1% growth, while local economists predict mid-single-digit growth in closed sales rather than any dramatic surge.

Perhaps most significantly, for the first time since 2022, buyers are projected to spend less than 30% of their income on housing payments. That's a meaningful threshold that fundamentally changes what's affordable and what's not.

The Seattle metro area housing market is expected to remain "somewhat soft" and "somewhat in favor of homebuyers" throughout 2026. What this means in practice: we're moving toward a more balanced market, one that finally gives buyers the time and leverage they haven't had in years.

What I'm Seeing Locally

From my perspective in Snohomish County, homes that are priced right for today's market—not last year's, not 2021's—are selling. But "priced right" means something very different now than it did even eighteen months ago.

I'm seeing homes sit that would have had multiple offers two years ago. Buyers are qualified and motivated but no longer willing to stretch beyond what makes financial sense. Meanwhile, sellers would often rather wait than accept an offer that feels like defeat, even when that offer represents fair market value.

The truth is, this isn't a bad market—it's a normal market. The 2020-2021 frenzy was the anomaly, an outlier driven by pandemic panic and historically low rates. What we're experiencing now is what real estate actually looks like when it's not artificially inflated by once-in-a-generation circumstances.

The 2026 Outlook: Who Has the Advantage?

For Buyers: Your Window Is Here

If you've been sitting on the sidelines waiting for the "right time," 2026 is shaping up to be that moment. Here's why this year could work in your favor.

You have more negotiating power now than you've had in years. Sellers have been humbled by 2025's reality, and the competition you would have faced in 2021—ten offers, all cash, waived inspections—is gone. You'll have room to negotiate inspection repairs, closing costs, and timing without feeling like you're being unreasonable.

Affordability is genuinely improving. With income growth outpacing home prices and the sub-30% income threshold within reach, your dollars go further than they have in years. This isn't just about rates dropping slightly—it's about the fundamental ratio of what you earn to what homes cost shifting in your favor.

Inventory continues to build, giving you actual choices instead of settling for whatever happens to be available when you're ready to buy. And many of those homes have been sitting for 45+ days, which means those sellers are ready to negotiate. That's where your leverage lives.

Perhaps most importantly, you have time to think. You can schedule multiple showings, sleep on decisions, bring your contractor for estimates, and make thoughtful choices instead of panic offers submitted in parking lots. With tech layoffs slowing and hiring starting to stabilize, the worst of the employment fear may be behind us.

The market isn't going to be "easy," but it will be fair in ways it hasn't been since before the pandemic.

For Sellers: Reality Check and Strategy

If you're planning to sell in 2026, success will come from accepting the new normal and pricing accordingly. Three types of sellers will emerge this year, and understanding which one you are matters.

The "wait it out" crowd has enough equity and financial stability to simply hold. With low delinquency rates and strong equity positions, they can afford to sit tight until conditions improve or until life circumstances force their hand. If you're in this category, that's a legitimate choice, but be honest about what waiting actually costs you each month.

The "try again" crowd represents shadow inventory—people who want to sell but are waiting for better timing. If that's you, spring (May through July) historically captures seasonal buyers with the most urgency. But this time, price based on what's actually sold in the last 60 days, not what Zillow said your house was worth last year or what your neighbor's home listed for.

The "finally realistic" crowd has accepted that 2021 isn't coming back. They understand the market doesn't care about renovation costs or memories, and they're pricing for today's reality from day one. These are the homes that will sell in 2026.

Consider your opportunity cost carefully. Every month you wait costs you mortgage payments, maintenance, and utilities. Sometimes selling for less than you hoped is still better than carrying a property that's draining resources. And if the numbers don't work for selling, could you rent it out? I wrote about this strategy in my article "Survive the Layoff: Turn Your Low-Rate Mortgage into Opportunity."

Making Your Move in 2026

Whether you're planning to buy or sell this year, here's your practical framework for making smart decisions.

If You're Buying:

Don't wait for rates to hit 4%—they're not coming back anytime soon. Focus on buying a home you can afford at today's rates, knowing you can refinance later if rates drop further. Work with a lender early, someone like Erica Andrews who understands the current lending landscape, so you're pre-approved and know exactly what you can negotiate with.

Look for homes that have been sitting. A house on the market for 45+ days signals a motivated seller, and that's your opportunity. Take your time with the process. This isn't 2021, and you can schedule second showings, bring your contractor for estimates, and think through decisions without fear of losing out to someone who waived everything.

If You're Selling:

Price for reality from day one. Overpricing means sitting empty while the market moves on, and every week that passes makes your listing look stale. Use recent closed sales—not active listings or your neighbor's opinion—as your guide.

Spring remains your best window, with May through July historically capturing the most motivated buyers. But be ready to negotiate. Buyers in 2026 have leverage they haven't had in years, so you can either meet them where they are or prepare to sit and wait.

Factor in your carrying costs honestly. Calculate what waiting actually costs you each month in mortgage, utilities, maintenance, and opportunity cost. Sometimes the right decision is selling now at a fair price rather than hoping for better conditions that may not materialize.

The New Normal

What we're experiencing isn't a crisis—it's a recalibration. The housing market is returning to fundamentals: reasonable negotiations, realistic pricing, and sustainable growth rather than the artificial frenzy of 2020-2021.

The sellers who succeed in 2026 will be the ones who accept this reality. Homes sit longer now. Buyers negotiate harder. The days of listing on Friday and getting ten offers by Monday are gone, and they're probably not coming back.

But if you're a buyer, this is genuinely your moment. The fear that kept you on the sidelines in 2021 is what's giving you power now. Sellers know they need to be realistic, inventory is building, and you have time to make thoughtful decisions instead of panic offers.

For the first time in years, the market is rewarding patience, preparation, and realistic expectations rather than FOMO and desperation. That's not a crisis—that's an opportunity for both sides to make decisions that actually make sense.

If you're thinking about buying or selling in 2026, let's talk. I've been watching this market shift in real time, and I can help you figure out whether now is your moment or if you should wait just a little longer.

And if you're exploring your financing options, reach out to Erica Andrews at Generations Home Loans (@andrewshomeloans). She's helped our Windermere team and clients navigate some of the toughest lending conditions in years.

2026 won't be easy, but it will be fairer. And in this market, fair is exactly what we need.

Marc Bostian is a real estate broker with Windermere Snohomish, specializing in property management and helping homeowners navigate complex market conditions in King and Snohomish Counties.